Power pinch to be the key driver in Johor

Real estate growth hinges on access to electricity and water

By Joseph Wong

While Johor continues to lead Asia in the growth of industrial estates, data centres and residential developments, a new and formidable bottleneck is emerging. Industry experts are warning that the defining theme of the 2026 real estate market will not be land availability or capital but rather the battle for the tap and the plug.

According to new data and strategic insights released today by Juwai IQI, the rapid proliferation of high-consumption industries is leading to a power pinch. In this scenario, access to electricity and water becomes the primary determinant of a project’s viability and valuation.

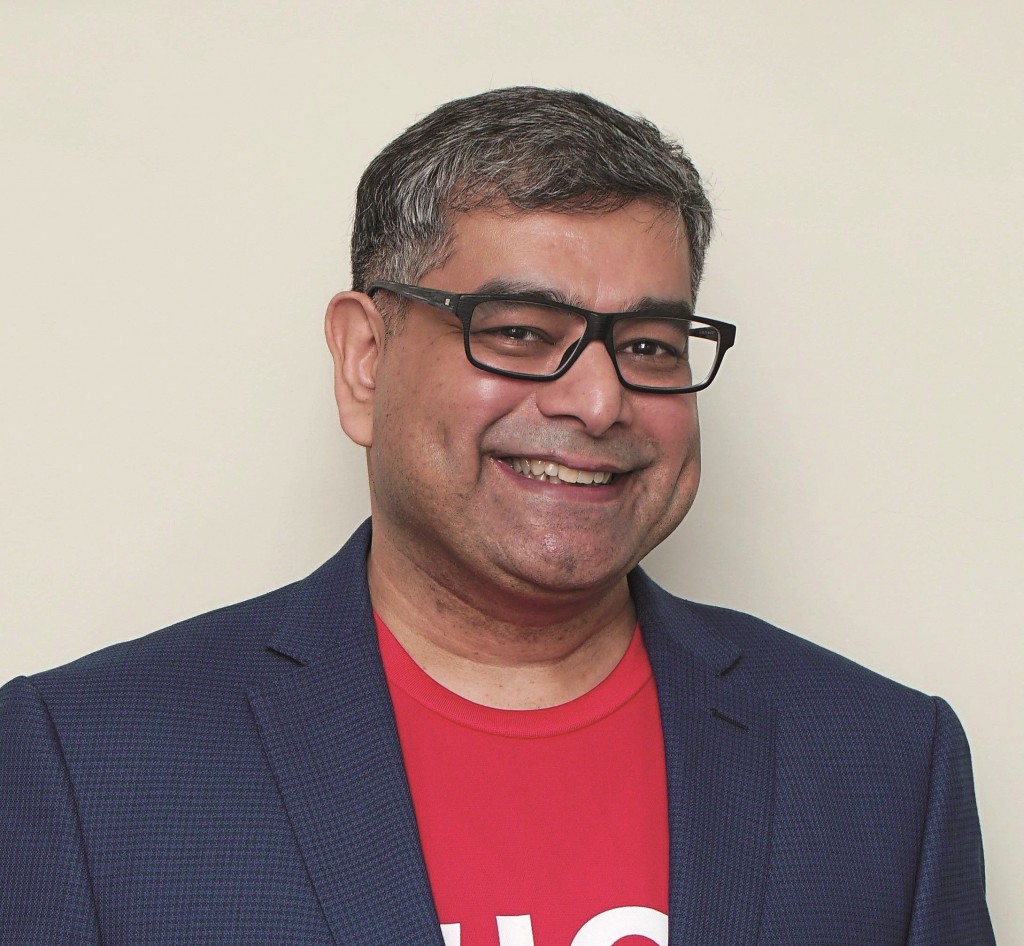

Juwai IQI co-founder and group chief executive officer Kashif Ansari highlighted that while Malaysia is currently navigating a vital data centre boom, the sheer scale of these operations is placing unprecedented strain on national utilities.

“Every form of property development requires water and electricity. It just so happens that Malaysia is in the midst of a data centre boom at the moment, which is vital for economic growth. But it’s also true that a single large data centre can draw about the same amount of electricity as hundreds or thousands of households,” Ansari noted.

“And while a typical Malaysian uses about 245 litres of water per day, some of the less efficient data centres can use millions of litres of water per day to keep their equipment cool. Both the federal and state governments are working quickly to fix the shortfall. Even so, in 2026, the demand for electricity and water will still increase more quickly than the new supply. This year, data centres will account for up to 90% of all new power demand in the country,” he said.

Fuelling the multi-billion-ringgit boom

The surge is driven largely by the global explosion of Artificial Intelligence (AI). Tech giants are currently deploying capital at a historic scale. Microsoft has committed roughly US$80bil (RM324.2bil) to AI infrastructure while OpenAI is estimated to be spending upwards of US$500bil (RM2.026bil).

Malaysia has successfully positioned itself as the fastest-growing data centre market in Asia, hosting more than two-thirds of all capacity currently under construction in Southeast Asia. The appeal is clear: pro-growth government policies, strategic proximity to Singapore and a stable environment. And this phenomenon is not just in Johor. High-quality investments such as AMD’s 209,000 sq ft research facility in Penang underscore the shift toward high-tech industrialisation.

Furthermore, Malaysia’s technological sovereignty is growing. The launch of the local AI Language Model, Intelek Luhur Malaysia Untukmu (ILMU), which reportedly outperforms global leaders like ChatGPT in Bahasa Malaysia and Manglish contexts, further incentivises the localisation of AI computing power within the country.

Navigating the bottleneck

With utility access now acting as a de facto gatekeeper for development, Juwai IQI has outlined five critical strategies for real estate players to transform this infrastructure bottleneck into a competitive advantage.

1. Prioritise infrastructure-ready land

In the current climate, speed-to-market is the ultimate currency. AI operators and data centre developers are increasingly willing to pay a premium for land that already possesses secured access to high-tension power and industrial water lines. “For these operators, the ability to go live quickly outweighs the desire to save on the land purchase price,” Ansari explained. By securing land with existing utility certainties, developers can bypass the years of bureaucratic and technical delays associated with grid upgrades.

2. Design for high-value versatility

Traditional industrial bare-bones sheds are becoming obsolete in high-growth corridors. Developers are advised to over-spec their projects from the outset. By increasing floor loading capacities, ceiling heights, power redundancy and cooling infrastructure, a building can pivot from a basic warehouse to a high-remuneration tenant like a chip testing facility or an advanced manufacturing hub. This flexibility ensures the best possible return on investment regardless of market shifts.

3. Focus on decentralised tech hubs

The Trophy CBD Office Tower is no longer the safest bet for investors. Instead, the focus is shifting toward decentralised tech hubs. Locations such as Bangsar South, Damansara Heights, the KL Sentral fringe and Cyberjaya are becoming the epicentres of AI-adjacent employment. These nodes offer the digital infrastructure and lifestyle amenities that tech professionals demand, leading to higher occupancy rates and superior rental yields compared to traditional central business districts.

4. Residential clustering near tech nodes

A major overlooked opportunity lies in residential development near AI clusters. In regions like Johor, Cyberjaya and Penang, there is a growing demand for tech-professional-ready housing. This market segment seeks rental-friendly units equipped with high-speed fibre-to-the-premises (FTTP) and modern security. Tech professionals represent a stable, mid-to-high-income demographic with lower-than-average turnover rates, providing a resilient income stream for residential investors.

5. Sync timelines with grid upgrades

Timing is everything in a utility-constrained market. Juwai IQI advises developers to align their project completion dates with the scheduled delivery of major infrastructure upgrades. This includes not only electrical grid and water facility improvements but also massive transport projects like the Johor Bahru–Singapore Rapid Transit System (RTS). Aligning with these milestones allows developers to justify price escalations as the surrounding area becomes more utility-rich and connected.

As Johor enters this high-growth phase, the power pinch serves as a reminder that real estate value is fundamentally tied to the ground it stands on as well as the wires and pipes that feed it.

“In summary, in 2026, the real estate market will be shaped by access to power and water. Infrastructure will be a main driver of value. Developers and investors who plan around it will earn the highest profits,” Ansari said.

The real estate market will be shaped by the simple physics of access. Developers and investors who treat power and water as strategic assets, rather than just utilities, are the ones who will realise the highest profits in this new landscape. The message for the industry is clear. In the race to build Johor’s future, those who control the power control the market.

Source: StarProperty.my

POST YOUR COMMENTS