Having savings for a comfortable home

By Joseph Wong

Retirement is a much-anticipated phase in our lives – a time when we can finally relax at our own homes, travel to foreign lands or just savour the rewards of all that hard work. However, the question arises: Do you have enough to live comfortably?

A quick survey showed that the sum ranges for the different income earners with the lower income earners hoping to hit at least RM500,000 by the time they retire while the middle income earners estimate a range from RM1mil to RM3.5mil to live comfortably. Needless to say, the higher income earners have their finances well in hand so even if they retired early, they would still have incoming revenue from their investments.

Each income group has its own set idea of retirement. For the lower income group, most would be satisfied if they could fully pay for their homes with sufficient savings for living expenses as well as maintenance and repairs of their homes.

The lower end of the middle income group has similar tendencies although a number hope to have enough savings for holidays abroad. In contrast, the higher end of the middle-income group has invested in more than one property, to generate rental income for their retirement. A few have also invested in shares, fixed deposits and life assurance policies for future usage.

Property a must

One common denominator is that all the income groups agreed that having a property is vital, especially in their retirement days as a home provided a more secure future, even if the cash flow was limited particularly for the lowest income group. In a worst-case scenario, a home could be sold for living expenses if income ceases.

There appears to be an inherent fear especially among the lowest income group, usually referred to as the B40 (Bottom 40%), that they would have to live on the streets and scrounge for food in garbage dumps if they do not have at least a roof over their heads. So to this income group, having affordable housing within their limited budget is vital.

It is intriguing how the middle-income demographic can be broken down into three distinct groups, with the bulk falling within the lower bracket. A smaller segment occupies the upper echelon of this category, while the rest find themselves squarely in the middle. On the highest end, the T20 has an elitist 1% but generally, this income group has multiple properties, not to mention other forms of investments.

Behavioural changes

However, it must also be noted that in this modern period, there are several behavioural changes in the mindset of many retirees and soon-to-retire individuals, particularly those in the empty-nest stage. Parents, whose children have left home to start their own families, are beginning to opt for assisted living homes. Notably, this group tends to be of the higher income group. The lower income groups have fewer choices and until when they can no longer fend for themselves, they would opt for nursing homes or retirement homes, depending on their budgets.

With assisted living homes, these provide a residential environment tailored to meet the needs of seniors who require assistance with daily tasks like medication management, health monitoring and personal care. Unlike nursing homes or retirement communities, these facilities prioritise promoting independence and autonomy while providing personalised support services. Additionally, they serve as a haven for post-surgery patients seeking specialised care to aid in their recovery process and regain independence. Equipped with specialised tools and resources, these facilities offer tailored support for surgical recovery and rehabilitation, assisting stroke patients in regaining physical capabilities.

Retirement calculator

So to figure out one’s retirement sum is simple enough. The KWSP i-Akaun offers a retirement calculator that provides an objective assessment of an individual’s financial status and helps in planning for future adjustments. This tool assists users in determining the required amount for a comfortable retirement, ensuring freedom from financial worries.

By analysing savings projections, the calculator highlights any gaps between projected retirement needs and current savings. This valuable insight empowers individuals to refine their financial strategies and make necessary changes to ensure a more secure future.

Using the calculator is straightforward: users input their basic monthly salary, average annual increment, annual bonus, dividend estimates and desired retirement age. The calculator then calculates the total savings, providing a clear estimate of retirement funds. This tool offers ease and efficiency, revealing the approximate savings individuals can expect at retirement and guiding them on their financial planning journey. Alternatively, the Private Pension Administrator also has a retirement calculator which can be accessed at https://www.ppa.my/retirement-calculator/

Regardless of which income group one falls in, proactive financial planning is essential. Planning allows individuals and households to better navigate economic uncertainties, achieve their financial goals and secure their long-term well-being. By taking proactive steps to manage finances, such as budgeting, saving and investing wisely, individuals can enhance their financial resilience and ensure a more stable future, regardless of their income level. Ultimately, the power of foresight and prudent financial management transcends income brackets, offering everyone the opportunity to build a brighter financial future.

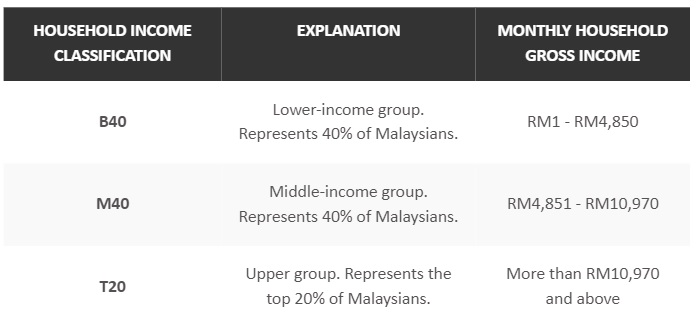

Understanding Malaysia’s income classifications – The B40, M40 and T20

In Malaysia’s socio-economic landscape, the terms B40, M40 and T20 have become ingrained in discussions surrounding financial policies and assistance programs. These classifications delineate different strata of income earners within the population, each representing distinct segments of society with varying economic circumstances.

The B40 segment refers to the Bottom 40%, encompassing households with the lowest income levels. These are often the most economically vulnerable individuals and families, grappling with financial challenges and limited access to resources.

Contrastingly, the M40 category represents the Middle 40% of income earners. These households enjoy a moderate standard of living but may still encounter financial constraints and struggle to meet certain expenses, particularly in the face of economic fluctuations.

At the upper echelon, the T20 group comprises the Top 20% of income earners, typically characterised by higher disposable incomes and greater financial stability. Members of this segment often have access to better educational and employment opportunities, contributing to their elevated socioeconomic status.

Understanding these income classifications is crucial for policymakers and stakeholders as they shape policies and initiatives aimed at addressing income inequality and promoting socio-economic development. By identifying and targeting specific segments of the population, governments can tailor interventions to meet the unique needs of each group effectively.

Over the years, Malaysia’s government has recognised the importance of periodically revising household income classifications to reflect changing economic realities and demographic trends. Consequently, updates to these classifications have been made to ensure their relevance and accuracy in capturing the socioeconomic landscape.

In recent years, the government undertook another round of revisions, expanding the classifications to include 10 additional sub-categories. This enhanced granularity provides policymakers with a more nuanced understanding of income distribution dynamics, enabling more targeted and effective interventions.

The detailed classification system facilitates comprehensive planning and monitoring efforts, allowing policymakers to identify areas of income disparity and implement targeted programs to bridge the gap. By addressing the specific needs of different income groups, governments can foster inclusive growth and ensure that economic opportunities are accessible to all segments of society.

Malaysia’s income classifications serve as a critical tool for understanding the socioeconomic landscape and guiding policy interventions to promote equitable development. By delving deeper into the nuances of these classifications, policymakers can devise more effective strategies to address income inequality and foster sustainable economic progress for all.

Source: StarProperty.my

POST YOUR COMMENTS