KIP REIT’s NPI jumps 15.2%, declares 1.55 sen DPU

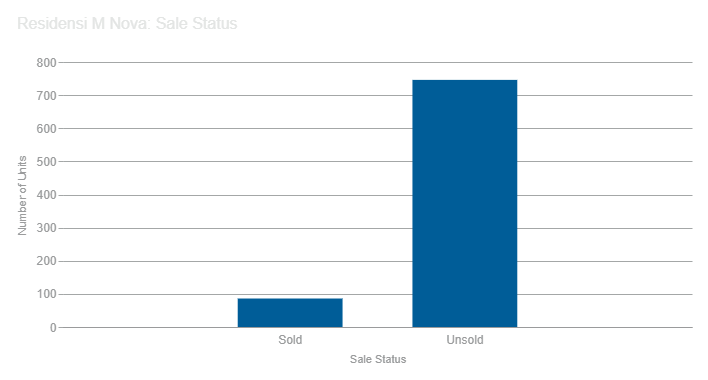

KUALA LUMPUR (Oct 20): KIP Real Estate Investment Trust (REIT) reported a 15.2% surge in net property income (NPI) for the first quarter ended Sept 30, 2023 (1QFY24), despite its NPI margin declining marginally to 73.8% during the quarter compared with 74.1% in the corresponding quarter.

The higher NPI of RM16.52 million during the quarter was attributable to the 15.6% jump in its gross revenue during the quarter to RM22.37 million from RM19.35 million in the quarter ended Sept 30, 2022 (1QFY23).

The increase in gross revenue was due to the 9% increase in gross revenue from the retail properties as well as the absence of revenue from industrial properties during the same quarter last year. The industrial properties contributed 5.74% to the REIT’s gross revenue during the quarter under review.

“The investment properties from retail and industrial segment contributed 94.3% and 5.7% of the KIP REIT total revenue respectively whilst Southern, central and Northern region contributed 49.5%, 29.3% and 21.3% of the KIP REIT total revenue from retail segment respectively,” the REIT manager said.

The higher NPI, as well as lower expenses during the quarter, led to KIP REIT’s distributable income surging 17.7% year-on-year to RM10.69 million during the quarter.

Earnings per share for the quarter rose to 1.71 sen, up from 1.61 sen in 1QFY2023. The group declared an income distribution of 1.55 sen per share for the quarter totalling RM9.4 million, to be paid on Nov 23.

“For the retail segment, the Southern region remained the highest revenue contributor with three malls in the region reporting gross revenue of RM10.4 million or 49.5% of the total revenue. The Central region’s three malls recorded revenue of RM6.2 million or 29.3% while the sole mall in the Northern region contributed RM4.5 million or 21.2% of the total revenue,” KIP REIT said.

Regarding prospects, the group is optimistic given the positive performance of its existing property portfolio and its strategic efforts to actively enhance leasing and operational strategies while pursuing high-quality investments.

“With occupancy rates of over 90% across many of our KIPMalls, this demonstrates our ability to attract the right mix of shoppers and tenants to our properties. The retail segment will continue to be the primary driver of growth for KIP REIT,” said KIP REIT Chief Executive Officer Valerie Ong Pui Shan.

The group also announced that they have obtained unitholders’ approval for the proposed acquisition of KIPMall Kota Warisan, their eighth retail asset. The group is also on track to complete Asset Enhancement Initiatives (AEI) at KIPMall Bangi this year and will initiate AEI projects at other KIPMalls afterward.

KIP REIT’s shares closed unchanged at 90 sen on Friday, giving the group a market capitalization of RM539.68 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

Source: EdgeProp.my

POST YOUR COMMENTS